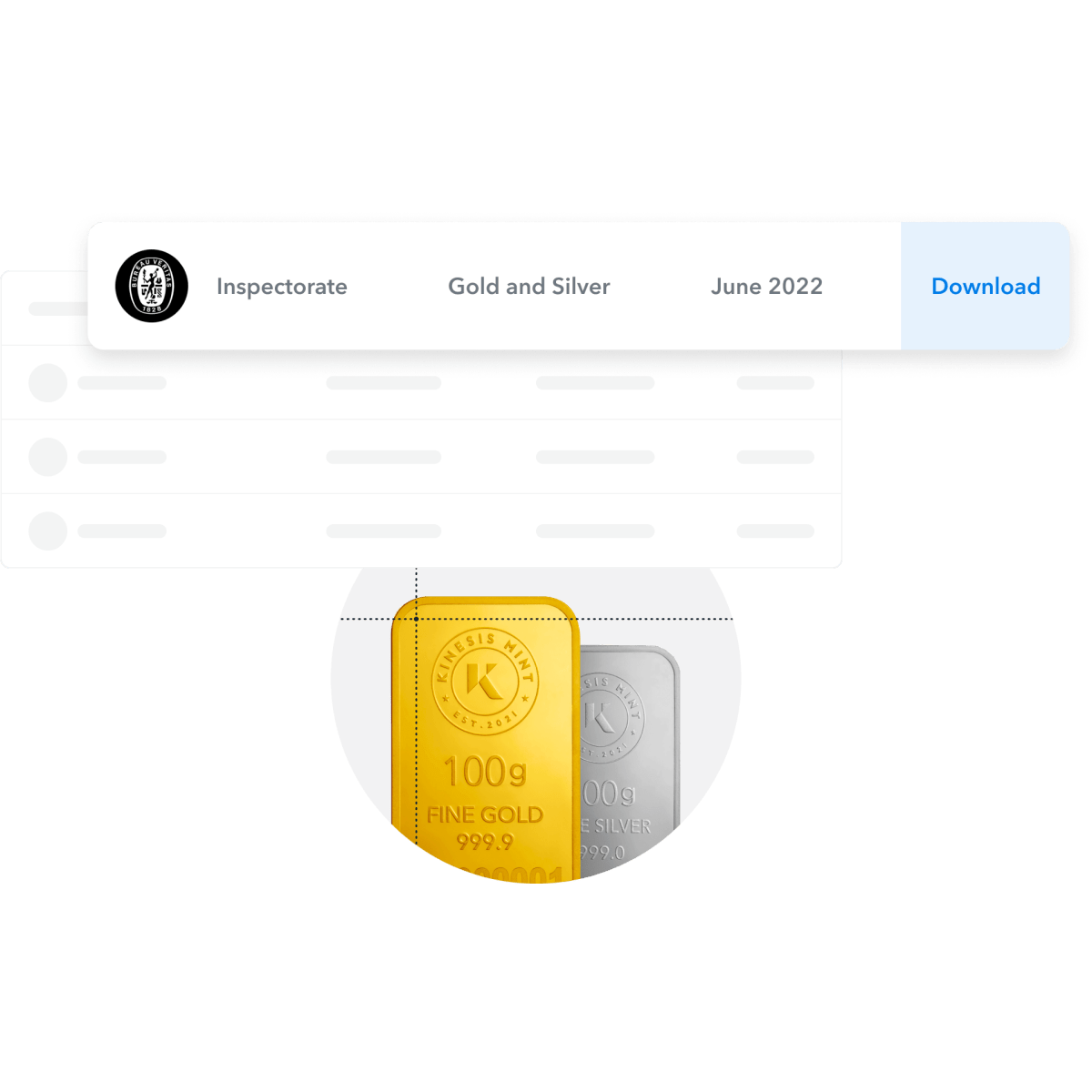

Secure & audited bullion vaulting

Quarterly independent third-party audits ensure that all Kinesis currencies are based on a 1:1 allocation of underlying bullion.

Your metal is independently audited

Independent third-party audits are conducted quarterly by leading global physical commodity audit and inspection specialist, Inspectorate, a Bureau Veritas company.

Our vaulting partners

Kinesis works closely with world-renowned vaulting partners; Brinks, Loomis Zurich and Malca-Amit, to guarantee the highest-grade security for your precious metals.

Audit archive

| Date | Audits | Audited by | Commodities |

|---|---|---|---|

| January 2024 | Download |

|

Gold and Silver |

| October 2023 | Download |

|

Gold and Silver |

| July 2023 | Download |

|

Gold and Silver |

| April 2023 | Download |

|

Gold and Silver |

| January 2023 | Download |

|

Gold and Silver |

| June 2022 | Download |

|

Gold and Silver |

| November 2020 | Download |

|

Gold and Silver |

| March 2020 | Download |

|

Gold and Silver |

Kinesis gold (KAU)

1 Kinesis gold (KAU) is backed by 1 gram of fully allocated, audited gold bullion

Kinesis silver (KAG)

1 Kinesis silver (KAG) is backed by 1 ounce of fully allocated, audited silver bullion.