How many Bitcoins are in circulation already? How many Bitcoins are mined per day? Find out how crypto’s limited supply impacts its price.

Bitcoin, the original cryptocurrency, has a hard-cap limit of 21 million, after which no more coins will ever enter the market. As of today, 30th April 2021, there are already over 18,695,225 Bitcoins in circulation, with only 2,304,775 still left to mine. Yet, this number keeps constantly evolving, as additional 900 coins get virtually unearthed every single day.

With 89% of the entire supply already excavated by eager treasure diggers, it might be a good moment to contemplate how the finite quantity of Bitcoin reflects on its value as an asset.

Is it worth investing in Bitcoin?

The innate volatility of the crypto market throws one persistently reappearing boomerang of a question at investors: is it worth investing in cryptocurrency or is it just a bubble ready to burst at any minute? Ever since Bitcoin emerged as an exciting novelty in 2009 and ballooned for the first time in 2014, the general public has been shaking its head in sceptical unison. Indeed, the past decade has accustomed traders to Bitcoin’s tendency to soar across the market charts like a deflating balloon.

With the crypto market alternating between spiking surges and flash crashes, it is important to also acknowledge the advantages that virtual currency brings to the table. Admittedly, Bitcoin has benefits that could potentially persuade traders to look past its wildly fluctuating price.

Bitcoin is durable, divisible, and convenient to trade. Yet, its limited supply is probably one of the strongest arguments towards considering a long-term investment in crypto. Bitcoin’s hard-capped finite supply equals scarcity, which controversially renders the virtual currency a hard asset, according to some experts.

What is a hard cap in crypto-lingo? What are hard assets?

- A hard cap is a non-bypassable limit, placed by a blockchain’s code, categorically determining the maximum amount a particular cryptocurrency can ever reach. After exhausting the hard-capped supply, it is impossible to create more of that crypto.

- As the name suggests, hard assets are tangible assets, hard to obtain or produce, equipped with a fundamental value which they can hold long-term, usually appreciating over time.

Surprisingly, considering Bitcoin as a hard asset juxtaposes the cryptocurrency with another form of money, endowed with similar qualities – gold. However, it would be a false equivalence to examine the similarity of these two forms of capital. Bitcoin is ultimately bereft of any intrinsic value, while gold is historically recognised as a stable store of value. Yet, scarcity is the factor equipping them both with market-measurable significance.

Does limited supply affect Bitcoin price?

As Satoshi Nakamoto, the pseudonymous Bitcoin creator explains in his emails to the software engineer and developer Mike Hearn, “If Bitcoin remains a small niche, it’ll be worth less per unit than existing currencies. If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit.”

Today, it would be oxymoronic to consider Bitcoin a small niche. The reality seems to have greatly surpassed the careful expectations of Satoshi’s educated guess, as quite the opposite scenario is playing itself out on the financial markets. Bitcoin has become mainstream, paving the way for new decentralised, digital money architecture, as the currency consequently strengthens its reputability on the market. Every day another major company decides to get involved in crypto, accepting it as payment (as in the WeWork & Tesla examples) or even paying wages in cryptocurrencies, presenting an alternative to fiat standard as the designated form of money.

How much will Bitcoin be worth in 2030?

Although providing an accurate prognosis is incalculable, a single Bitcoin is currently expected to be worth between $100,000 – $200,000 by the end of the year, and $500,000 – $1,000,000 by 2030, according to some experts.

Cryptocurrency has emerged as a new market class and a speculative addition to many investors’ portfolios. Although highly volatile, the overall predictions are progressively positive. In the accompaniment of its current media popularity uprising, Bitcoin’s value has continuously increased. Bitcoin price has famously grown tenfold just over the course of one year, seeing a wave of entirely new market participants joining the race and subsequently contributing to its bullish run.

Is Bitcoin bad for the environment?

The staggering level of Bitcoin accumulation can only be topped by the amount of energy required to generate this impressive heap of wealth. Bitcoin mining consumes enough power to easily place itself amongst the top 30 energy consumers worldwide – more than the entire country of Argentina. China’s mining empire, currently responsible for over 75% of world Bitcoin mining, is expected to hit 130 million metric tonnes of carbon emission by 2024.

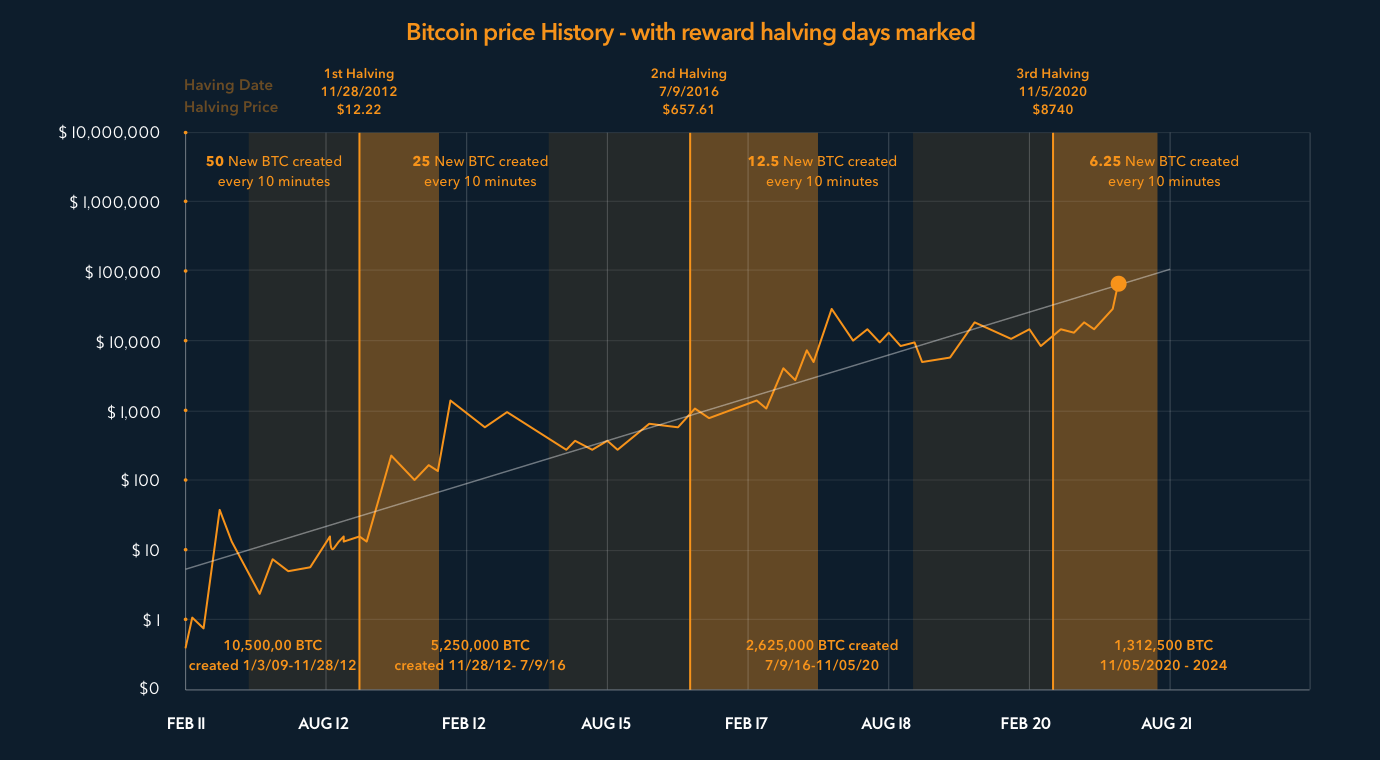

The upsurge of interest in crypto as a new market class is interconnected with its scarcity and the accelerating difficulty to obtain new coins. The looming vision of Bitcoin’s halving flared up its popularity amongst crypto miners. Every 210,000 blocks, the reward for mining gets cut in half, stimulating the mining race further.

What is Bitcoin Halving?

- Halving ensures that new coins do not enter the market too rapidly, as mining requires more resources and energy when compared to the expected return. Simultaneously, the required increase in mining efforts puts pressure on Bitcoin’s price, raising its value and preventing inflation, as a result.

When will all Bitcoins be mined out?

Currently, a new block of Bitcoins appears every 10 minutes, in 6.25 increments, gradually reducing the already modest supply. Although 89% of all Bitcoins have been mined in just over a decade, the escalating difficulty slows the process down exponentially. Currently, it is anticipated that the process will take approximately a century, with the last Bitcoin mined in 2140. In accordance with the law of supply and demand, as the number of available coins decreases, the demand increases, and so – in theory – should the price.

The creation of Bitcoin has not only ushered in a new age of decentralized money. By having a strict limit installed in its code protocol, it also introduced a far-seeing stipulation, which prospectively determined its economic significance for the future to come.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.